Background

Rising interest rates from 2022 to 2024 constrained the U.S. real estate market, driving property values downward on average 20%.

By early 2024, however, pricing data signaled that property pricing had reached its low point and started to recover, ushering in a new cycle for the market.

Fast forward to today, and we see continued increases in property valuations with property pricing increasing across many real estate sectors.

This highlights the ongoing recovery and, while uncertainties remain around factors such as unemployment, tariffs, inflation, and interest rates, the data suggests that the market has moved past its most challenging phase.

Markets move in cycles, and it’s likely that U.S. commercial real estate has entered a promising new phase of growth and opportunity.

Mark Khuri shares a brief overview of the purpose and strategy behind Alternative Fund IV:

Alternative Fund IV Investment Summary

SMK Alternative Fund IV is a professionally managed private real estate fund designed to provide investors with passive income, meaningful diversification, and attractive long-term growth.

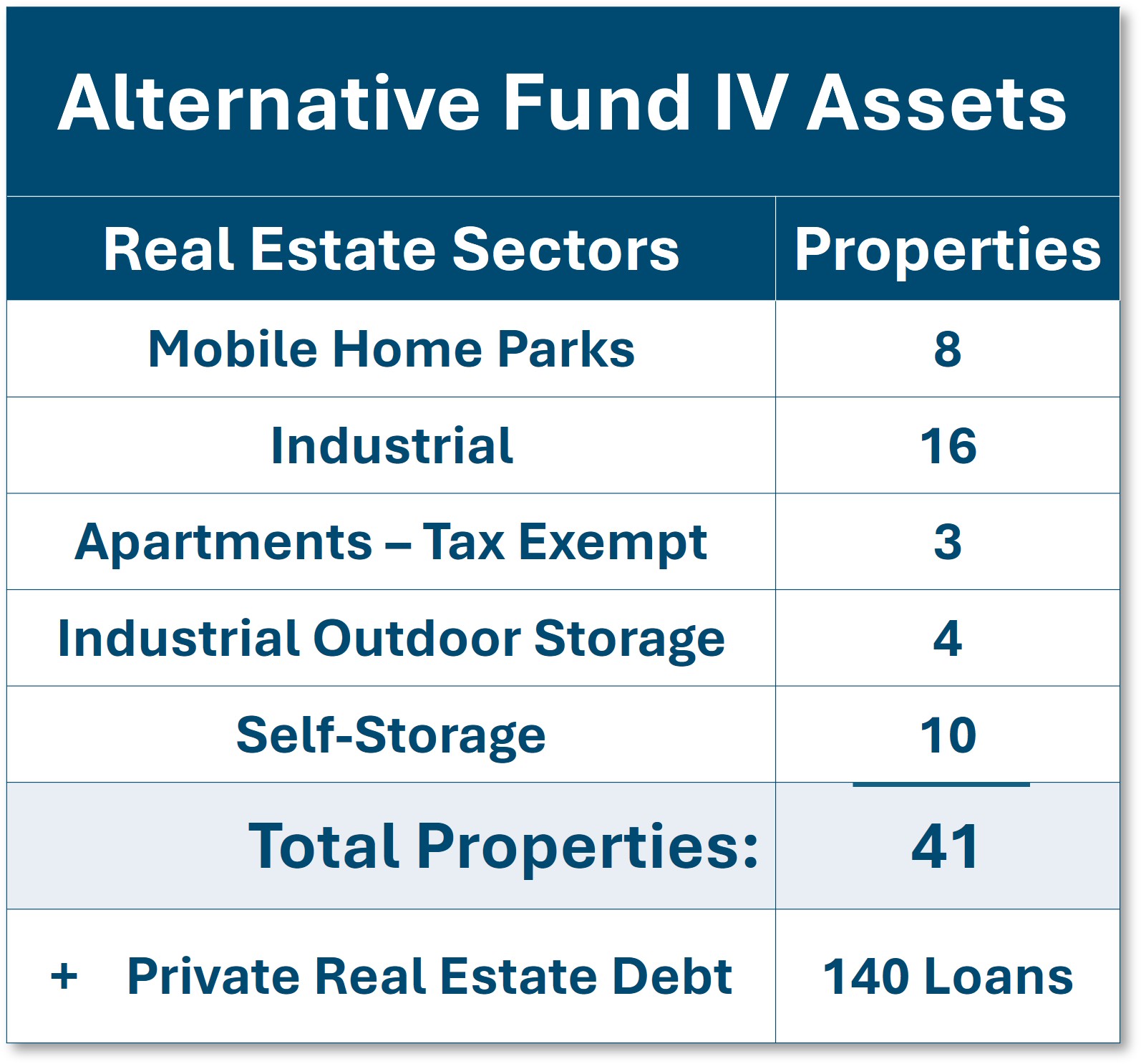

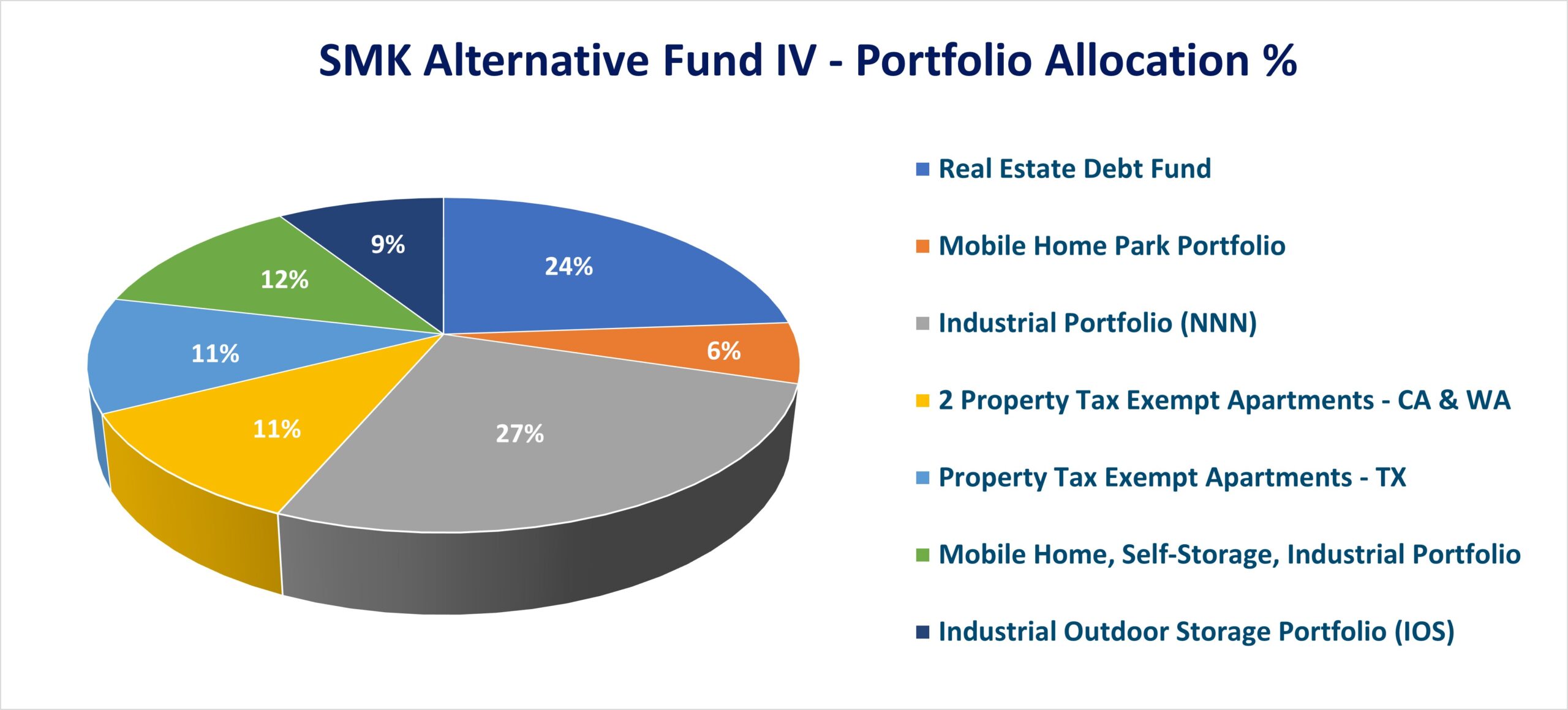

The Fund invests across resilient asset classes including industrial, mobile home parks, self-storage, apartments, and private real estate debt, working with top-tier operating partners nationwide.

The Fund’s investment strategy targets a balanced return profile: consistent annual cash flow supported by strong appreciation potential. Investors benefit from downside protection through diversification across multiple properties, geographies, and business plans.

The structure also offers compelling tax efficiency, including accelerated depreciation and cost segregation, which can generate passive losses in year one that help offset taxable income.

Since launching the Fund in early 2025, we have reviewed more than 550 investment opportunities and strategically invested in 7 institutional-quality assets including:

Fund IV Highlights

The Fund will be closing soon, with distributions already underway at the upper end of our projections, and additional investments planned as we complete the portfolio.

Investing now enables participation in a nearly built-out portfolio with reduced early-stage execution risk.

- Capital is diversified across multiple asset classes, regions and operating partners.

- The Fund invests with several repeat and best in class operating partners that each have very attractive track records

- This investment is targeted to provide a highly attractive blend of in-place income and growth.

- The projected investment duration = 5+ years with a focus on adding value in the early years, returning investor capital through property sales, refinances and redemption requests, in years 2-4 (dependent on market conditions), and holding for income and long term growth.

- Professionally managed Fund focusing on capital preservation with downside protection

- Combine lowly correlated recession resistant asset classes into a portfolio for passive investors

- Favorable tax benefits including accelerated depreciation and cost segregation are estimated to provide passive investors with passive losses in year 1.

Gain a superior hedge against inflation through:

-

- Blended return of consistent income + asset value growth

- NOI growth from rent increases and expense reimbursements

- MHP + SS tenants are less price sensitive compared to other asset classes

- NNN Industrial lease structure has built in rent escalation clauses and protects investors from rising expenses (tenant pays all)

Investment Offering:

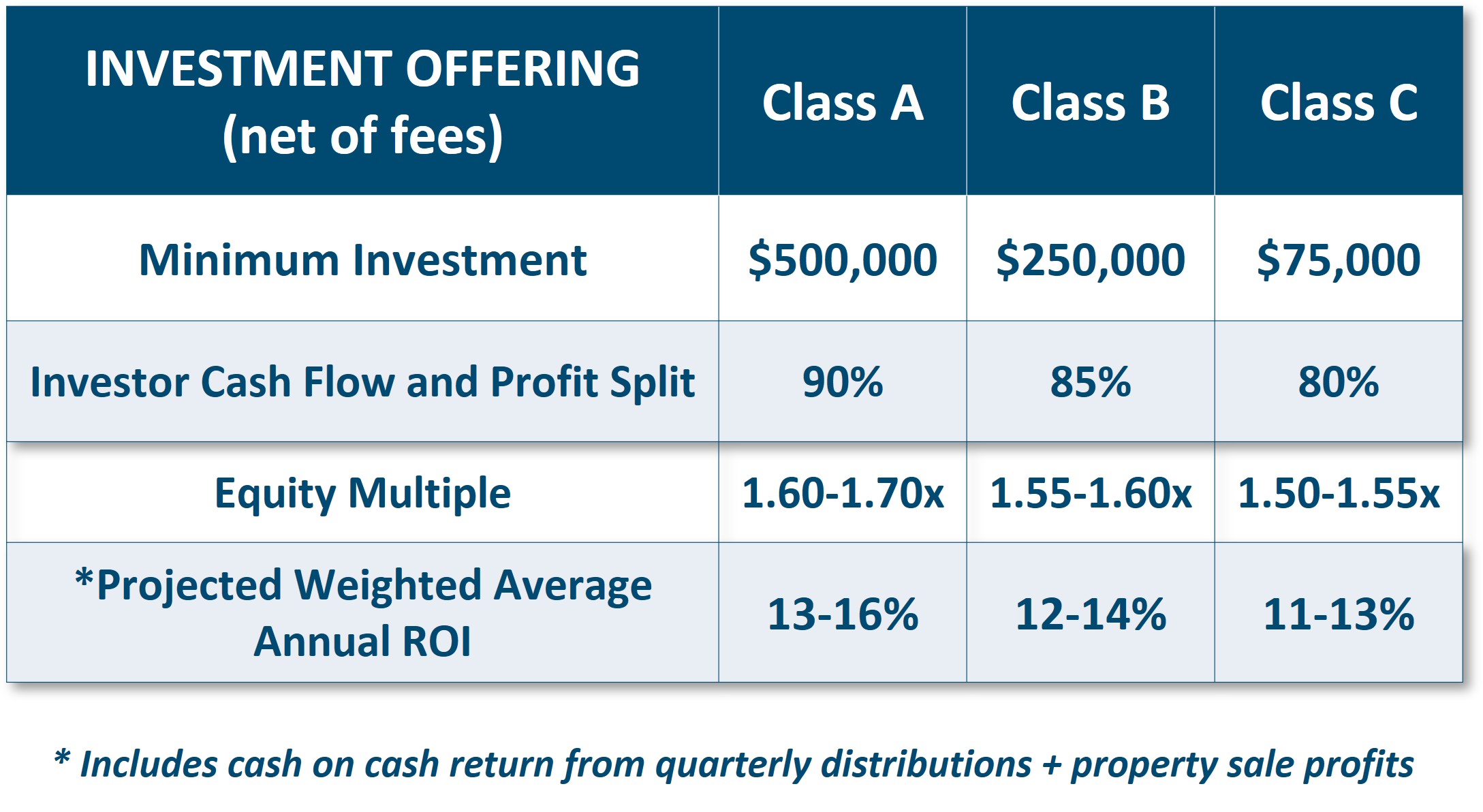

This opportunity is an ideal fit for accredited investors looking for income and growth through a diversified portfolio.

We have 3 Class shares available for investors, Class C have a $75,000 minimum investment and Class B have a $250,000 minimum and Class A have a $500,000 minimum:

*Contact us for special terms on investments >$1,000,000

Closing Notice!

The Fund will be closing at the end of March, with distributions already underway and additional investments planned as we complete the portfolio.

Investing now enables participation in a nearly built-out portfolio with reduced early-stage execution risk.

Login To Access Full Details & Next Steps: