- Immediate cash flow from day one

- Tax advantages with passive losses in 2025

- Diversification across 20 properties in 11 states, providing lower risk and steady returns

- Low leverage for reduced risk and stability

Why Invest in Mobile Home Parks and Self-Storage?

SMK, we’ve been successfully investing in these asset classes for over 10 years, delivering consistent returns for our investors.

Here’s why we continue to believe in them:

- Recession Resistance: Mobile home parks and self-storage have proven to be recession-resistant, consistently outperforming other real estate sectors during economic downturns.

- Strong Demand: As housing costs rise, mobile home parks offer a critical affordable housing solution, while the demand for self-storage is growing due to downsizing and the need for additional space.

- Limited Supply: Zoning restrictions limit the development of new mobile home parks, ensuring strong demand, while self-storage benefits from consistent tenant retention due to convenience and low costs.

- Reliable Cash Flow: These assets provide stable, predictable cash flow with long-term tenants and flexible lease structures, allowing for regular rent increases.

Why Now?

Now is an ideal time to invest, as prices for mobile home parks and self-storage facilities have dropped, creating opportunities to acquire these assets at attractive valuations.

Despite the volatility in commercial real estate over the past few years, these assets have continued to perform well, offering consistent cash flow and stability.

This combination of lower acquisition costs and proven resilience makes this an excellent time to consider an investment.

Portfolio Highlights:

- ~92% of assets sourced off-market, direct to seller

- Conservative leverage has been utilized which is reflected in the portfolio’s low LTV of 24.6% (as of 12/2024)

- Several properties have been acquired with all cash, providing an opportunity to increase future investor returns with the use of a new $50m credit facility with Key Bank

- Four self-storage facilities were recently refinanced with 10-year fixed-rate debt. Thanks to a 31% rise in total revenue and a 50% increase in NOI since the acquisition, our operating partners were able to withdraw $3 million in proceeds

- As a result of buying right and implementing value-add strategies, two mobile home communities were recently appraised for 46% higher than the initial acquisition cost

Investment Offering:

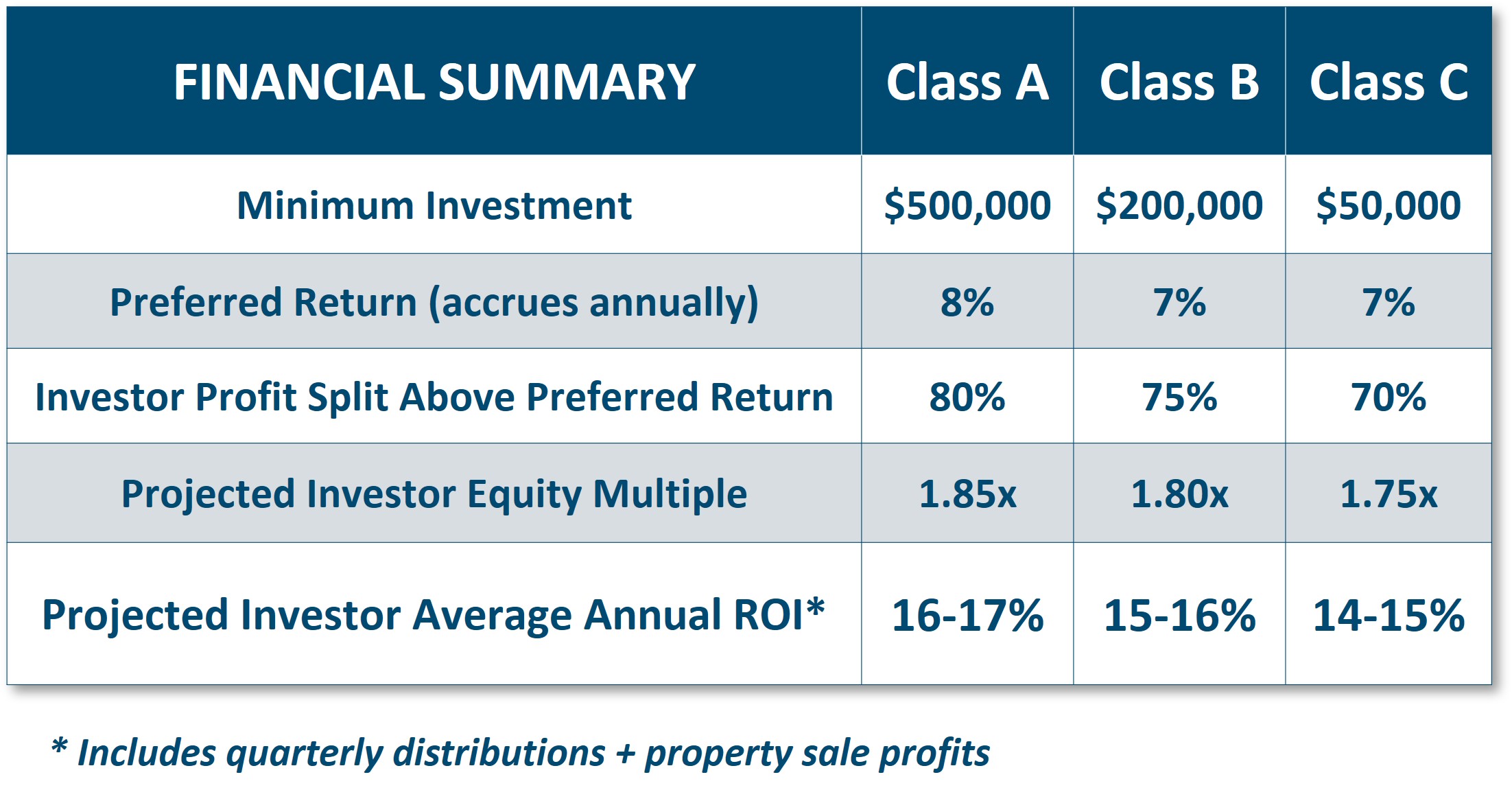

We have 3 Class shares available for investors, Class C have a $50,000 minimum investment and Class B have a $250,000 minimum and Class A have a $500,000 minimum.

Please contact us for special terms on investments above $1,000,000: