Over the past 15 years we have invested in many different real estate asset classes and strategies, ranging from short term house flipping and short-term debt, to long term buy and hold apartment communities to investing in stabilized producing oil fields.

There are an endless amount of investment options out there and the risk vs reward spectrum of each must always be considered and carefully analyzed.

Let’s do a simple comparison to help illustrate what we mean here. Most real estate development projects would be considered higher risk investments often due to riskier loan terms and the fact that development projects produce no cash flow for several years. This higher risk strategy may provide investors a higher annualized ROI between 20-30%+.

On the opposite side of the spectrum is a stabilized Class A property in a primary market with 100% occupancy, rental rates at market and with no deferred maintenance. This opportunity would be considered much “safer” and likely to produce consistent annual cash flow between 3-5%.

It is more critical now to be extra careful when considering an investment and to ensure you are comfortable with the risk reward spectrum.

Here are a few questions to ask when analyzing an opportunity:

-

- What are the best and worst-case scenarios? What is the likelihood of each to occur?

-

- How did this investment strategy perform during the 2008 Great Recession? This question alone can help you steer away from higher risk investments.

-

- If revenue at the asset drops 10%, 20%, 30% how is the overall performance affected?

-

- What is the breakeven occupancy?

-

- What is the likelihood of the property value to increase and what will cause it to do so, natural market appreciation or net operating income growth or maybe both?

There is no perfect investment, all involve risk, and all have at least one variable that is less favorable.

In our experience, after buying, selling and investing in more than 100 properties, there lies a strategy that continues to provide attractive risk adjusted returns. A strategy that offers investors downside protection without sacrificing performance and ROI.

It is not a secret, it’s not sexy nor groundbreaking, one of our favorite investment strategies is a blend of Core Plus and Value-Add investing.

Simply put, Core Plus and Value-Add real estate investments are where you can grow the property value without relying solely on speculative market appreciation.

Core Plus investments often require less operational improvements while Value-Add investments tend to need more work. Both strategies can result in forced asset value appreciation.

There are many ways to force appreciation, this is where a highly experienced operating partner with a trained team in place to execute on the business plan, is critical to success.

How to Add Value and Force Appreciation?

Let’s start with 2 common strategies to increase the net operating income and corresponding valuation of a commercial real estate asset:

1) It’s easy to understand the strategy of increasing the monthly rental rate being charged, this will increase the revenue of the asset.

2) Billing back certain utilities to tenants would reduce expenses.

Let’s dive deeper into other less known value-add strategies that we like to see implemented at our properties:

1) Offer Upgrades: When leases come up for renewal, offer existing residents a selection of upgrades they can choose from for signing a new lease at a higher rate. This can include new light fixtures, new blinds, new plumbing fixtures, new flooring, installing laundry hookups in the unit etc. This strategy allows your unit to remain occupied while increasing the appeal and corresponding rental rate

2) Create Additional Revenue Generators: Offering residents amenities (for a fee) such as valet laundry, bundled Wi-Fi, Amazon package lockers, covered parking, sheds and on-site self-storage, all can increase the property revenue

3) Focus on Tenant Retention: Renewing leases of existing residents is very important. When residents choose to renew rather than move, it directly impacts the bottom line. Renewals reduce turnover expenses and reduce vacancy

Here Are A Few Effective Tenant Retention Strategies:

- Determine how to make the property more appealing and desirable. Adding or upgrading amenities often helps: such as a pool, dog park, fitness center, a fun club house, pickle ball court, soccer field, outdoor grilling area and a business center

- Ask tenants what they want and give it to them! If residents are asking for more security, install security cameras or perhaps hire a night patrol

- Offer residents a simple incentive to renew their lease without having to incur much cost such as an Amazon Gift card, a gas card or free carpet cleaning

- Have tenants refer their friends and family, they’ll be less likely to move when it comes time to renew

- Create a community feel amongst residents by hosting regular on-site events such as free ice cream sundae making, free car wash days,picnics & barbecues, karaoke nights, fitness classes etc.

The bottom line: Keep your residents happy

Happy residents are more likely to stay at your property even if you raise the rent each year

4) Reduce Expenses: every expense line item should be scrutinized to determine where cost savings can be achieved. Here area few strategies:

- Bundle contractors. Landscaping in the warmer months and snowplowing in the winter may be bundled and handled by the same company to cut costs

- Buy supplies in bulk whenever possible

- Replacing lighting and plumbing fixtures with more efficient fixtures can save thousands in costs each month. Low-flow high efficient toilets use about 75% less water than older toilets!

- Install utility monitoring software to detect leaks in real-time

- Install desert style landscaping

- Install photocell and motion sensor lighting which turn on and off automatically

Let’s look at recent examples of upgrading and improving property amenities.

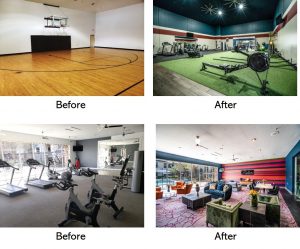

Below are before and after photos of the fitness center and basketball court at one of our apartment communities in Texas. The original fitness center was in a desirable location overlooking the pool but it was dated, while the basketball court was rarely being used:

Repositioning these common areas has provided residents with a lounge by the pool and a much more vibrant fitness center where yoga and fitness classes are now being held.

Next…Part 2 where we review how to calculate the benefit of implementing these strategies.