We have been investing in self-storage facilities with partners since 2013. Recently, 3 of our self-storage investments sold earlier than planned to a private REIT. The property sales provided over 20% annualized return to investors which was higher than initially projected.

Below is a brief summary of the 3 self storage facilities that sold:

Facility #1: Naples, FL

- 517 unit facility built in 2003 purchased for $7,535,000 in 2015

- Value add included increasing physical occupancy from 82% to 88% and converting 30, 10x10 units into 60, 5x10 units and increasing the overall gross rental income

- Sold for $8,722,000 providing investors with over 20% annual return on investment

Facility #2: Fayetteville, NC

- 1,242 unit facility built in 1995 purchased for $6,750,000 in 2013

- Value add included increasing physical occupancy from 70% to 80%+, increasing gross rental income and renovating several areas with deferred maintenance including the showroom

- Sold for $9,649,000 providing investors with over 20% annual return on investment

Facility #3: Spring Hill, FL

- 570 unit facility built in 1995 purchased for $5,874,000 in 2013

- Value add included increasing physical occupancy from 82% to 87%+, increasing gross rental income by 6% shortly after acquisition

- Sold for $6,633,000 providing investors with over 20% annual return on investment

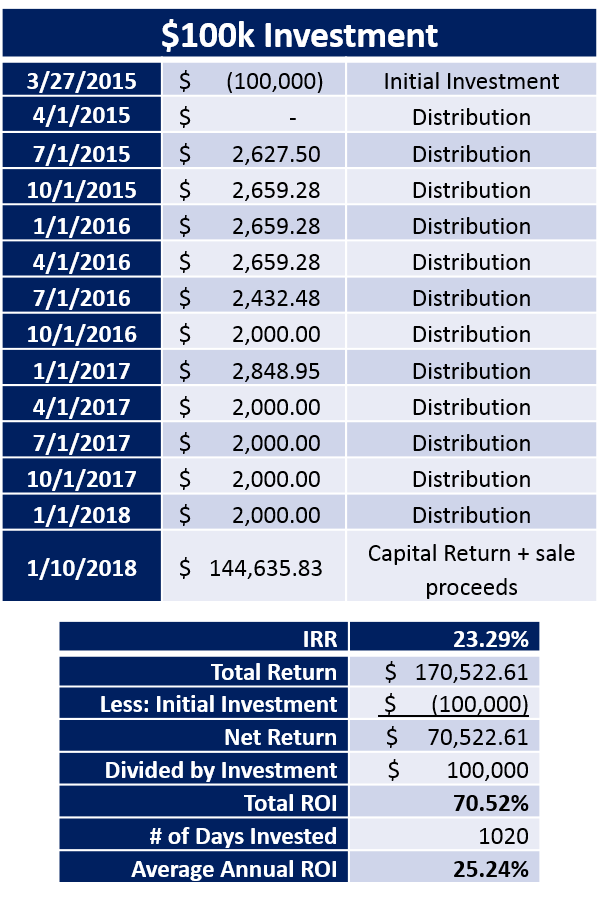

What Do The Returns of a $100,000 Investment Look Like?

Each of these facilities was producing positive rental income within a few months of acquisition and provided investors with consistent quarterly passive income up until the property sale.

Below is a summary of the cash flow distributions of a $100k investment in the Naples, FL property: