Summary

Dr. Khuri has been an avid real estate investor since the 1970's while Mark Khuri began investing in 2005. We focus predominantly on value-add investments where we increase an assets' value manually, rather than relying on speculative natural market appreciation.

In the early years, we focused about 80% of our efforts in residential property and 20% in commercial. As market conditions evolved, we stopped buying residential property and have been focusing 100% on commercial investments, where we see more attractive risk-adjusted returns.

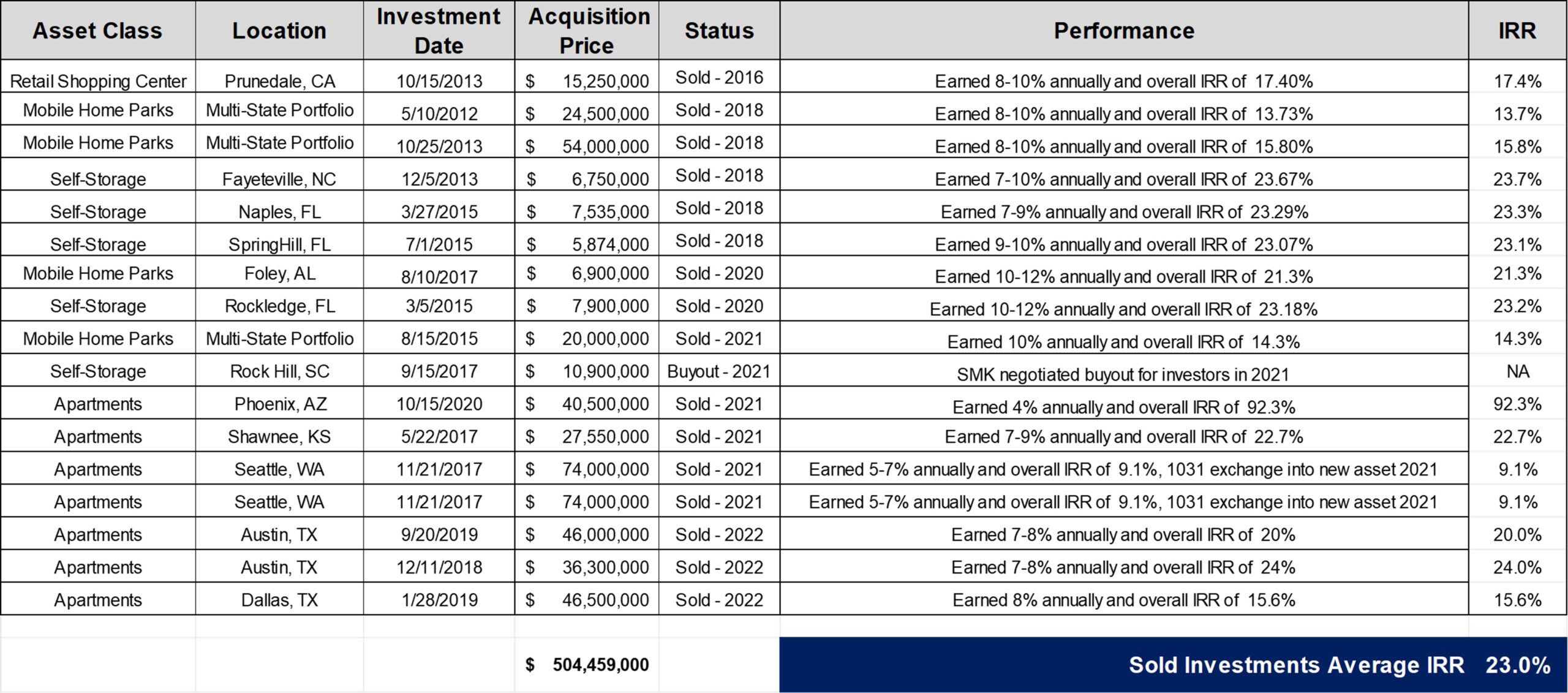

Management's Commercial Real Estate Exits

Note: Investments shown include personal investments from the partners of SMK Capital Management as well as company investments syndicated through SMK. Personal investment returns shown are net to LP’s, syndicated investment returns shown are net to our LP’s. Historical performance is not indicative of future results.

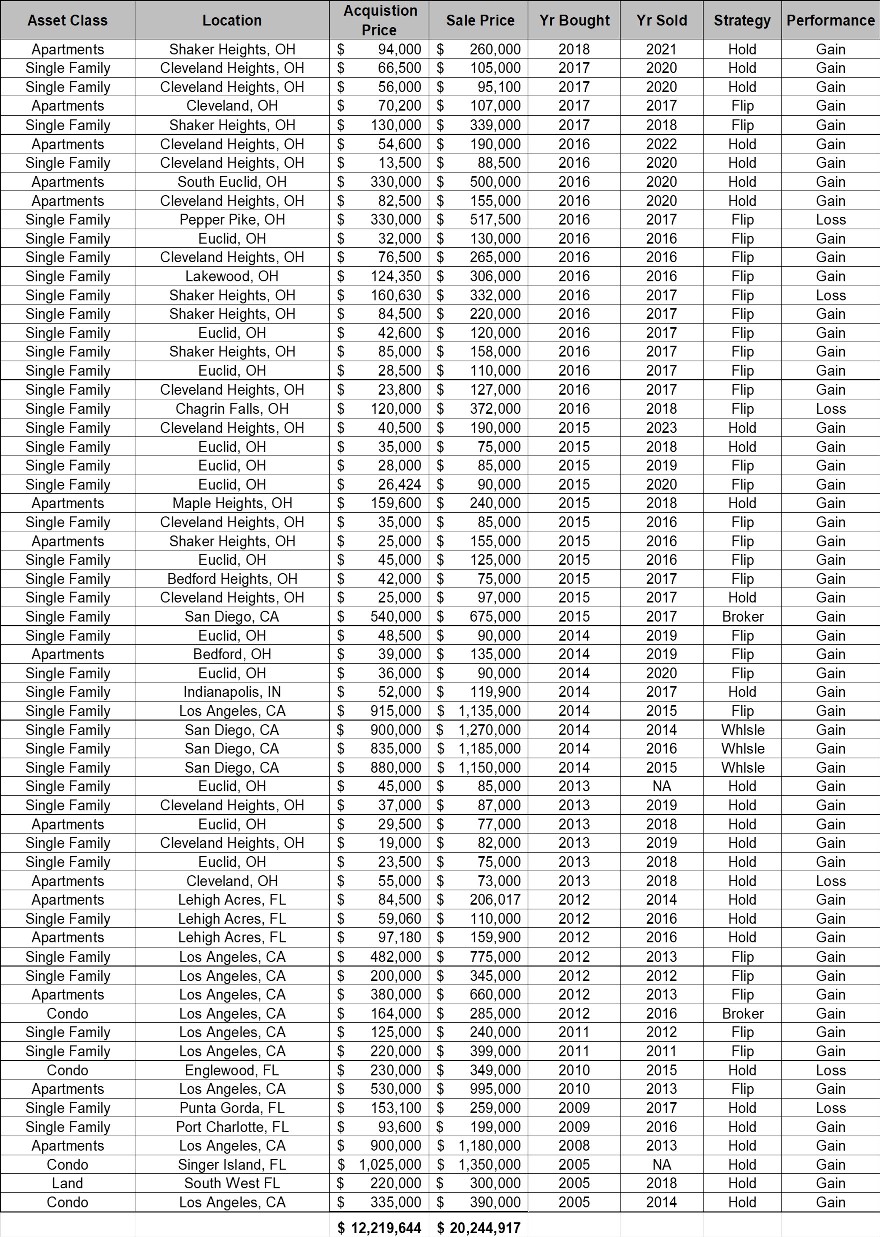

Management's Residential Real Estate Investments

FAQ's

How many deals has your firm done?

- Commercial: We have invested in over 70 separate private commercial real estate investments. This includes individual properties and also portfolios. Of these we have sold 16 and currently hold the remainder.

- Residential: We have invested in over 60 separate properties. This is a mix of single family homes and small apartments and we have sold all.

How have returns compared to the pro-formas?

- Commercial: Of the 16 investments that have sold, the average IRR was 23%. 10 out performed the pro-forma projections, 3 performed as projected and 3 performed well but slightly below projections.

- Residential: 58 that have sold provided positive gains, 6 were losses. The losses were higher risk, short term single family home flips.

Disclaimer: All investments involve risk. You should consult your attorney, financial advisor, and/or accountant to understand the risks of this investment prior to considering any investment in this fund. Any projections, estimates, or targets are aspirational only. No return is guaranteed. Any information reflecting past performance is no guarantee of any current or future performance. None of the information contained in this website constitutes any offer to sell nor is any information herein the solicitation of an offer to buy any security. Securities may only be purchased through offering documents which contain details about the risks associated with an investment in the fund. Any investment details herein or in the offering materials are believed to be reliable, but we make no representations or warranties as to the accuracy of such information and accept no liability therefor.